– Race and Single Parenthood Deepen Wealth Inequalities –

Contact:

Jennifer Farland, jennifer.farland@jfarland.com, 202-297-1261

Simona Combi, simona@globalpolicysolutions.org, 202-265-5111

Chicago, Ill., July 14, 2015—Single women have only 32 cents for every dollar of wealth owned by single men, a report released today by the Asset Funders Network (ANF) finds. The women’s wealth gap lies at the heart of other social inequities impacting children, families, and our nation.

“Women and Wealth: Insights for Grantmakers,” by Mariko Chang, finds wealth inequality between men and women at all ages and education levels, with great discrepancies by race and ethnicity. The report, which analyzes the 2013 Consumer Finance Survey data, recommends programs and policies that can help women build wealth, which grantmakers can create or support.

“’Women & Wealth: Insights for Grantmakers’ narrows the lens to examine the systemic barriers that continue to keep women from having the opportunity that men have to build wealth over their life course. Our economy suffers for this gender inequity,” said Joe Antolin, AFN Director. “Through this brief, AFN offers funders collaborative and proven investment strategies and challenges them to explore new more robust solutions to catalyze narrowing the gender wealth gap, strengthen the economy, sustain greater economic security with upward mobility for girls and women.”

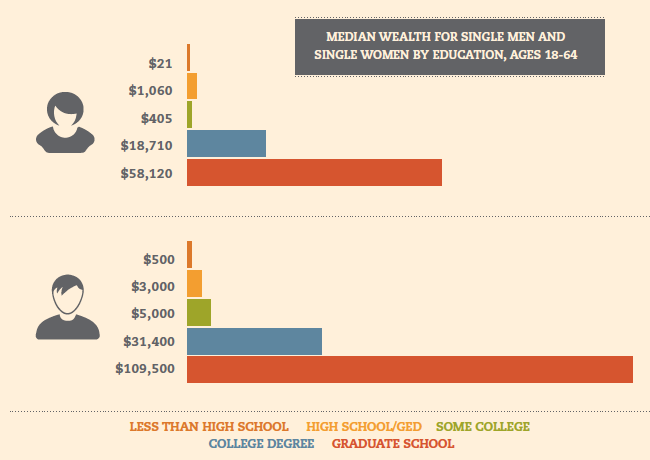

Education is not the great equalizer

At all levels of education, women’s wealth is much lower than that of men’s. In fact, the higher the degrees obtained, the bigger the difference in wealth. Men with graduate degrees have $51,000 more in wealth than women. Men with college degrees have $12,500 more wealth than their female counterparts.

“Women of color have less access to what I call the ‘wealth escalator,’ which consists of benefits like paid sick leave or access to 401(k)s,” says Mariko Chang, the report’s author and president of Mariko Chang Consulting. “Social Security benefits don’t take into account the years women spend as caregivers. Women of color also have a motherhood wealth penalty as primary breadwinners on a lower income. They face both a racial and a gender wealth gap.”

Race and parental status have an outsized impact on women’s wealth

Gender, race, and motherhood all take a toll on women’s ability to accumulate wealth. Black and Hispanic single mothers have no wealth and white mothers have $14,600. Black and Hispanic fathers are not much better off, at $50 and $1,250, respectively, while white single fathers’ net worth is $41,410. With two-thirds of mothers being sole breadwinners for their families, the economic security of today’s families rests more on the shoulders of women than ever before.

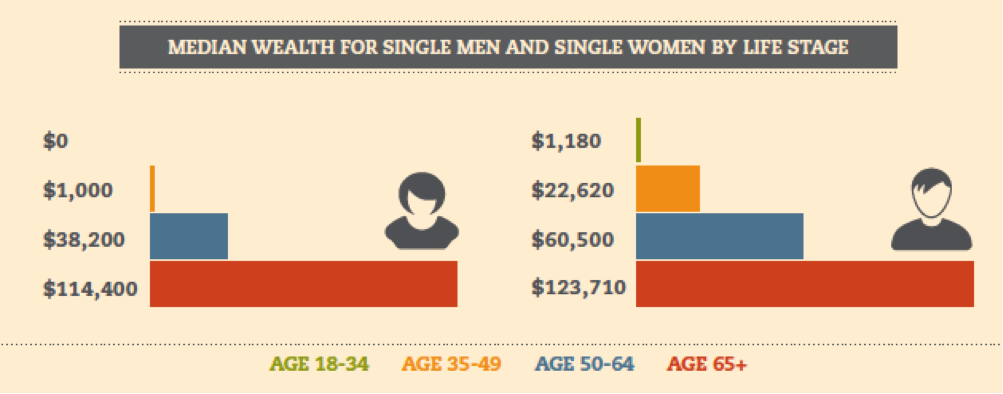

The wealth gap for women persists throughout their lifetime

Millennial women have zero median wealth and women ages 35-49 have $1,000. While millennial men only have a little over $1,000, men age 35-49 have $60,500 in wealth. At age 65 and over, women have more wealth, but that reflects the fact that many of them are widows and have inherited the wealth benefits of marriage. In reality, women are more likely to rely on Social Security for most of their retirement income. Because they live longer, they need more financial resources to support themselves, which makes the gender wealth gap bigger than it appears for seniors.

Policies and programs that can help close the gap include:

- Making child care affordable and available. There is a waiting time for childcare subsidies to become available. Foundations can create partnerships to cover the portion of childcare costs that a state subsidy would cover while single mothers are on the subsidy waiting list.

- Support affordable college completion. The cost of higher education increased by 62 percent between 2000 and 2012. More women going to college but they have to get student loans in order to do that, which then prevents them from accumulating wealth. Foundations can finance college scholarships, provide financial aid advising, help students complete the Free Application for Federal Student Aid, help them qualify for public financial aid, and provide support services to increase graduation rates.

- Support financially sound homeownership. Access to homeownership, a crucial way to build wealth, is very limited for women and people of color. Programs that provide counseling on homeownership and the home purchasing process to residents in subsidized rental units, and referrals to reputable lenders can bridge the gap to sustainable and affordable homeownership.

- Increase retirement savings. Lower earnings, lack of access to employer-provided retirement plans, and caregiving responsibilities lead to insufficient retirement savings. Grantmakers can set up such plans for low-income female workers.

- Support business startups. Create opportunities for women to learn business skills and engage in entrepreneurship, which will also fuel economic growth.

###

The Asset Funders Network is a community of national, regional and community-based foundations and grantmakers using philanthropy to make more effective and strategic funding decisions that allow each dollar invested to have greater impact in bringing economic opportunity and financial security to low- and moderate-income Americans.

The Center for Global Policy Solutions is a 501(c)3 nonprofit, think and action tank dedicated to creating a vibrant, diverse, and inclusive democracy in which everyone has the opportunity to achieve health, wealth, educational, and civic success.